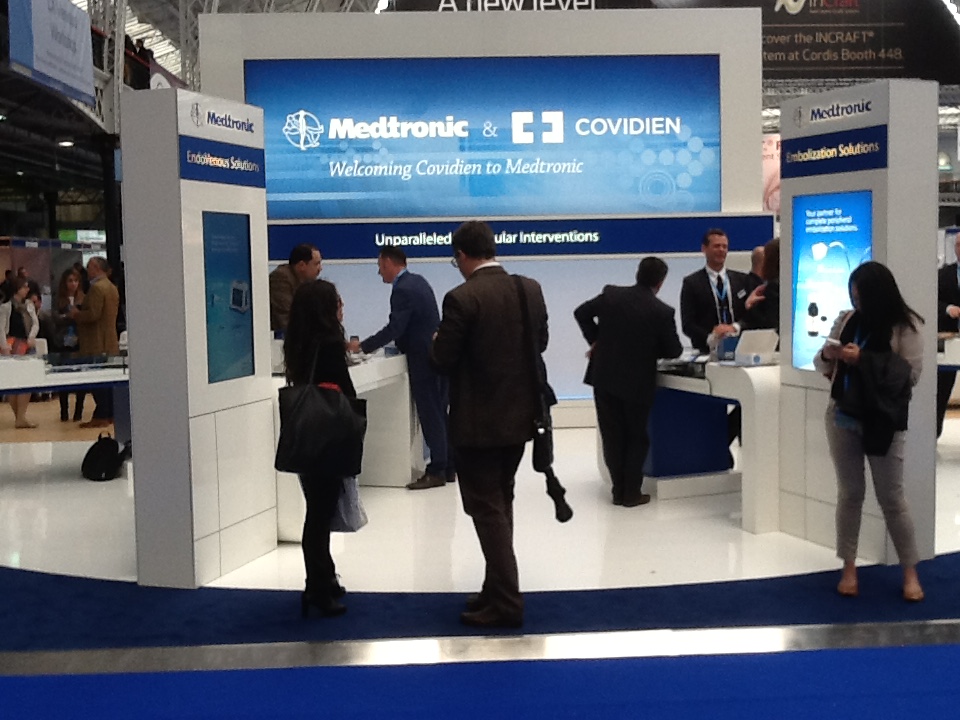

Medtronic e Covidien insieme … ecco i primi risultati finanziari

.Medtronic Reports Fourth Quarter and Fiscal Year 2015 Financial Results

-

Q4 Worldwide Revenue of $7.3 Billion Grew 7% on a Comparable, Constant Currency Basis; 60% as Reported

-

Q4 Non-GAAP Diluted EPS of $1.16; GAAP EPS were Break-even

-

Q4 U.S. Revenue of $4.1 Billion Grew 8% on a Comparable Basis; 67% as Reported

-

FY15 Revenue of $20.3 Billion Grew 19% as Reported, or 6% on a Comparable, Constant Currency Basis

-

Q4 Free Cash Flow of $1.7 Billion; GAAP Cash Flow from Operations of $1.9 Billion

-

Company Sets Initial FY16 Revenue Growth Outlook and EPS Guidance

Cardiac and Vascular Group

The Cardiac and Vascular Group (CVG) includes the Cardiac Rhythm & Heart Failure, Coronary & Structural Heart, and Aortic & Peripheral Vascular divisions. CVG had worldwide revenue in the quarter of $2.596 billion, representing an increase of 10 percent on both a comparable, constant currency basis and as reported. CVG revenue performance was driven by strong balanced growth across all three divisions.

Fourth quarter CVG U.S. revenue of $1.301 billion increased 15 percent, or 28 percent as reported. Fourth quarter CVG non-U.S. developed market revenue of $903 million increased 5 percent, or decreased 7 percent as reported. Fourth quarter CVG emerging market revenue of $392 million increased 11 percent, or 4 percent as reported.

Cardiac Rhythm & Heart Failure (CRHF) revenue of $1.398 billion grew 11 percent, or 4 percent as reported. CRHF performance this quarter was driven by low-teens growth in Low Power, mid-single digit growth in High Power, and strong growth of over 30 percent in AF Solutions. Geographically, the CRHF division benefitted from mid-teens growth in the U.S. and Japan. Low Power results were driven by the continued ongoing acceptance of the Reveal LINQTM insertable cardiac monitor and solid performance in the U.S. Pacing business, which grew in the upper-single digits. High Power results were driven by mid-single digit growth in the U.S. and double-digit growth in Japan. The VivaTM XT CRT-D with its AdaptivCRT® algorithm and Attain® PerformaTM Quadripolar Lead continue to show strong market acceptance. AF Solutions results were driven by continued robust growth of our Arctic Front Advance® CryoAblation System.

Coronary & Structural Heart (CSH) revenue of $792 million increased 9 percent, or 1 percent as reported. CSH performance was driven by upper-teens growth in Structural Heart and low-single digit growth in Coronary. Structural Heart growth was driven by Transcatheter Valves, which grew approximately 50 percent globally and approximately 30 percent in the U.S. based on the ongoing success of CoreValve® in the U.S. and the launch of the CoreValve® EvolutTM R recapturable system in CE Mark countries. Coronary benefitted from mid-single digit Drug Eluting Stent (DES) growth driven by the recent launch of Resolute OnyxTM in Europe and the continued acceptance of Resolute Integrity® DES in the U.S. The business also had low-double digit growth in balloons as a result of the recent launches of the company’s differentiated NC Euphora® and Euphora® SC balloon dilatation catheters.

Aortic & Peripheral Vascular (APV) revenue of $406 million increased 9 percent, or 69 percent as reported. APV performance was driven by very strong mid-teens growth in the Peripheral business, which is comprised of the legacy Medtronic peripheral business and a portion of the legacy Covidien Peripheral business, and low-single digit growth in Aortic. Growth in the Peripheral business was driven by the IN.PACT® Admiral® drug-coated balloon, which was launched at the beginning of the fiscal fourth quarter. The company estimates it now has the leading position in the U.S. Drug Coated Balloon market. This leadership position was attained without the benefit of having a full quarter of a combined Medtronic and legacy Covidien peripheral salesforce. Peripheral was also driven by strong double-digit growth in Chronic Venous Insufficiency (CVI) reflecting the continued acceptance of ClosureFastTM in Japan.

Minimally Invasive Therapies Group

The Minimally Invasive Therapies Group (MITG), formerly referred to as the Covidien Group following completion of the Covidien acquisition, includes both the Surgical Solutions division and the Patient Monitoring & Recovery division, formerly referred to as Medical Care Solutions by Covidien prior to the acquisition. The group had worldwide sales in the quarter of $2.387 billion, representing an increase of 6 percent. Incremental revenue from acquisitions contributed just over 1 percent to MITG growth. MITG revenue performance was driven by strong double-digit growth in Surgical Solutions and low-single digit growth in Patient Monitoring & Recovery.

Fourth quarter MITG revenue in the U.S. of $1.230 billion increased 6 percent. Fourth quarter MITG non-U.S. developed market revenue of $856 million increased 4 percent. Fourth quarter MITG emerging market revenue of $301 million increased 11 percent.

Surgical Solutions revenue of $1.293 billion increased 10 percent. Surgical Solutions performance this quarter was driven by high-single digit growth in Advanced Surgical, low-single digit growth in General Surgical, as well as growth of over 40 percent in Early Technologies, which benefitted significantly from acquisitions. Advanced Surgical results were driven by balanced low-double digit growth in both Stapling and Energy. Stapling growth reflected continued strong market adoption in the U.S. of new product introductions including the Endo GIATM Reinforced Reload. Energy results were driven by continued robust procedural growth in Vessel Sealing. Early Technologies results included strong growth across all three product lines: GI Solutions, Advanced Ablation, and Interventional Lung Solutions.

Patient Monitoring & Recovery (PMR) revenue of $1.094 billion increased 2 percent. Patient Monitoring grew in the mid-single digits, and both Airway & Ventilation and Nursing Care grew in the low-single digits, offsetting low-single digit declines in Patient Care. The strong U.S. flu season drove pulse oximetry sales.

Per leggere tutto il comunicato stampa di Medtronic cliccare qui