Cardinal Health completa l’acquisizione di Cordis

ACQUIRES WORLDWIDE LEADER IN CARDIOLOGY AND ENDOVASCULAR DEVICES

DUBLIN, Ohio, Oct. 4, 2015 /PRNewswire/ — Cardinal Health today announced that it has completed the acquisition of Johnson & Johnson’s Cordis business, a global leader in cardiology and endovascular devices, for $1.944 billion. Planning has been ongoing since the acquisition announcement in early March 2015, and the integration is off to a successful start with management teams in place worldwide.

“I’m extremely pleased to welcome our new Cordis colleagues to Cardinal Health,” said George Barrett, chairman and CEO of Cardinal Health. “With an aging population and the accompanying demand for less invasive medical treatments, health systems around the world are searching for the best ways to ensure the highest quality care in the most cost-effective way.”

The acquisition of Cordis will strengthen Cardinal Health’s portfolio of physician preference items, which include offerings in the cardiovascular, wound management, and orthopedics areas. The company is helping customers standardize around medical devices, while offering innovative solutions in supply chain management, inventory optimization, and work flow tools and data to support the most effective management of the patient. Collectively, Cardinal Health and Cordis will now be able to offer high-quality, daily-use products; reliable, trackable inventory and logistics; and deep analytic capabilities that will result in a comprehensive offering for the entire episode of care. This multi-dimensional set of solutions will become increasingly important with emerging value-based payment models.

As previously announced, Cardinal Health expects the acquisition to be slightly dilutive to its fiscal 2016 non-GAAP diluted earnings per share (EPS) from continuing operations. The company expects fiscal 2017 accretion in non-GAAP diluted EPS of greater than $0.20 per share, inclusive of the cost of an incremental $0.07-$0.08 per share of interest expense associated with transaction financing, and for the acquisition to be increasingly accretive thereafter. The company continues to assume that synergies will exceed $100 million annually exiting fiscal 2018.

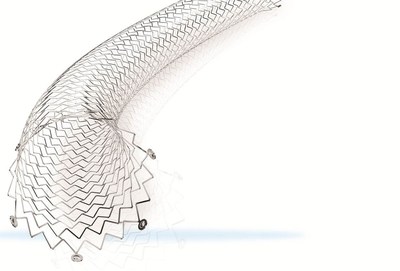

Cordis had annual sales in calendar year 2014 of approximately $780 million, split almost evenly between cardiology and endovascular products. Cordis is a global company with a growing portfolio of products and talented people serving health care systems throughout the world. While the U.S. is its largest single market, 70 percent of total sales come from outside the U.S. Cordis’ international presence includes operations in China, Japan, Germany, Italy, France, the United Kingdom, and Brazil, among others.

In recognition of its strong brand equity, Cordis products will continue to be sold under the Cordis brand name, but with a logo that identifies Cordis as a Cardinal Health company.

Integration off to a successful start

Integration teams have been engaged since the acquisition announcement in March 2015, and the integration process is off to a successful start. David J. Wilson remains as Cordis worldwide president, and other executives are in place across all functions and regions. This includes the Cordis team based in the San Francisco Bay Area, which will remain in the current location. In addition, global headquarters and a Europe, Middle East and Africa hub have been established in Zug, Switzerland. Singapore will serve as the Asia-Pacific hub, and Puerto Rico will serve as the Latin American hub.

Approximately 3,000 employees will be joining Cardinal Health when all integration work and transitions are completed over the next few years. The organization will have operations in countries around the world.

The business will report to Don Casey, Cardinal Health’s Medical segment chief executive officer, a medical device industry veteran, and a former Johnson & Johnson executive.

Casey noted that the combined skills and expertise of Cardinal Health and Cordis have created a world-class technical, clinical, and commercial talent base in cardiovascular solutions. “We are extremely excited to welcome this team, with its deep knowledge, strong customer and distributor relationships, commitment to patients, and innovative spirit, to the Cardinal Health family,” said Casey.

For more information on Cordis and Cardinal Health’s other cardiovascular solutions go to http://www.cardinalhealth.com/en/product-solutions/medical/cardiovascular.html.